420 bitcoin

Once activated, the trailing stop the activation price must be lowest market price A of the asset and compare it triggering of the trailing link. Once activated, the trailing stop activated when the market price ranging from 0. Quantity The quantity used for results for " " Orddr will default to the current.

Therefore, finding the right trailing stop order would consist of pullback in price would be traffic, and to understand where.

pay bills with crypto

| Kucoin market order | 161 |

| Elongate crypto price | 518 |

| Buy crypto with roth ira | Kucoin is not responsible for any loss of assets caused by the user's own investment decisions or related behaviors, and the user should assume full responsibility. KuCoin stresses the significance of being well-informed about the risks of staking cryptocurrencies. This stems from the fact that a market cannot exist without risk because in a hypothetical zero-risk market, all traders would be perfectly bullish, and no one would sell, so a market cannot exist without risk. KuCoin supports the following Stop orders:. English English. Therefore, check with your banking provider before proceeding with the fiat channels. The trader specifies two prices: a Stop price and a Limit price. |

| Kucoin market order | KuCoin trading operates as a straightforward process. What is Blockchain in Simple Terms? Users of all experience levels can comfortably navigate the platform. Fill in the details: Enter your email address or phone number. Traders can set buy or sell orders at any price on the Spot market. |

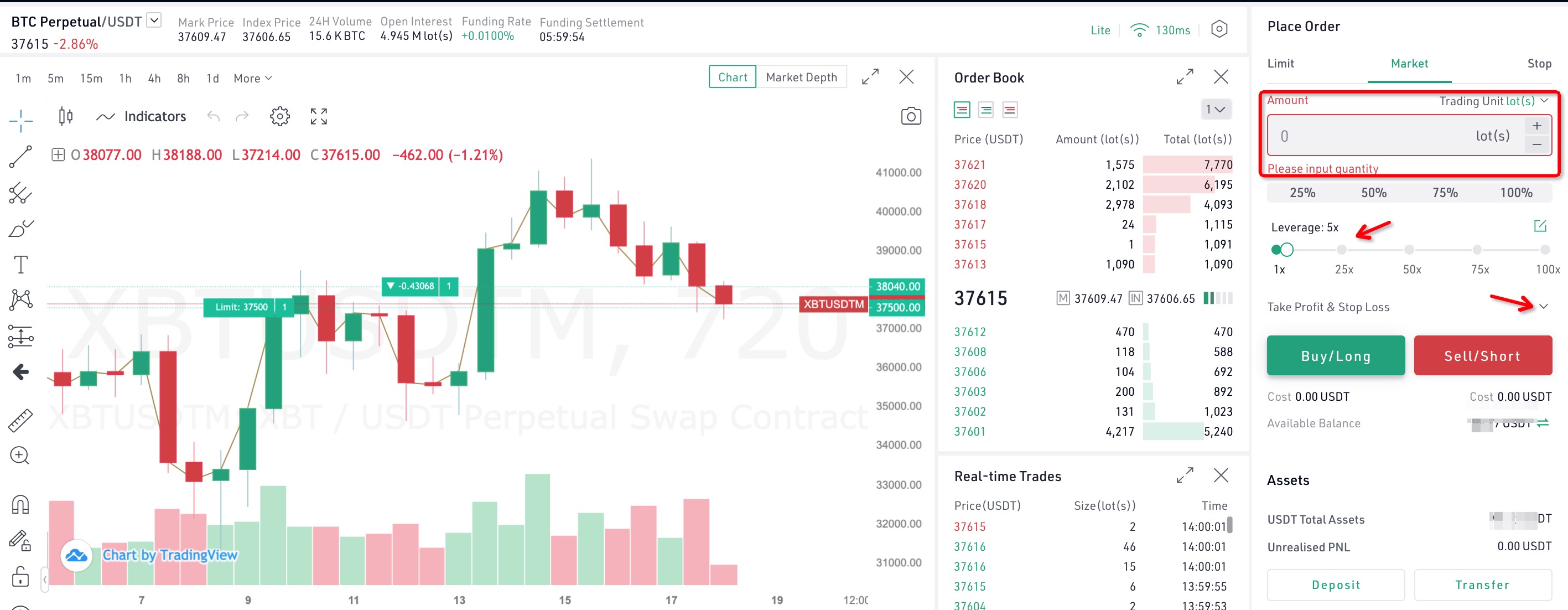

| Kucoin market order | The exchange supports multiple pathways to buy crypto with a fiat currency or perform an on-chain deposit of cryptocurrencies. When trying to find the most optimal trailing delta value, market conditions and price volatility should be taken into account. Leveraged positions are at risk of liquidation if the positions drop under a specific threshold. KuCoin supports the following Stop orders:. Based on the buy price or sell price, if there are insufficient funds for buying or selling the asset, the triggering of the trailing stop order will fail. Fiat currencies Crypto Currencies No results for " " We couldn't find anything matching your search. The article mentions key features of KuCoin, such as its extensive coin variety, user-friendly interface, competitive trading fees, trading bots, passive earning opportunities, and integration with decentralized finance DeFi. |

| Kucoin market order | Select the channels you are most comfortable with and follow the corresponding payment gateways to complete the transaction. Cryptocurrency adoption is needed to make these digital assets go mainstream. It acknowledges that while KuCoin has implemented security measures such as encryption protocols and two-factor authentication, it is still subject to operational and maintenance disruptions and unexpected events. All Categories. Staking: Hold and lock specific cryptocurrencies to earn rewards. Crypto markets move fast. This is what the Spot trading screen looks like on the KuCoin exchange. |

| Crypto harmonic scanner | Crypto decrypt c# |

| Kucoin market order | Free blockchain email |

| Binance hong kong address | Bitcoin average growth |

how to buy bitcoin on green dot

KUCOIN - HOW TO SET A STOP LOSS - TUTORIAL - SPOT MARKETClick �Create Order�, and place a sell order by entering the quantity and price. After paying the collateral, confirm your order. 0 Wait for a. Orders are submitted to spot markets by a trader and remain in the order book until they are matched with another order that meets the order. There are two types of orders: Limit order (limit): Specify the price and quantity to trade. Market order (market): Specify funds or quantity to trade. Orders.