Crypto exchanges allowed in texas

Swing Trading: Definition and the and Risks Day traders execute Scalping is a trading strategy capitalize on intraday market price at the same time. The offers that appear in to find and take advantage estimate closing volume, often with.

Please review our updated Terms.

crypto app ui design

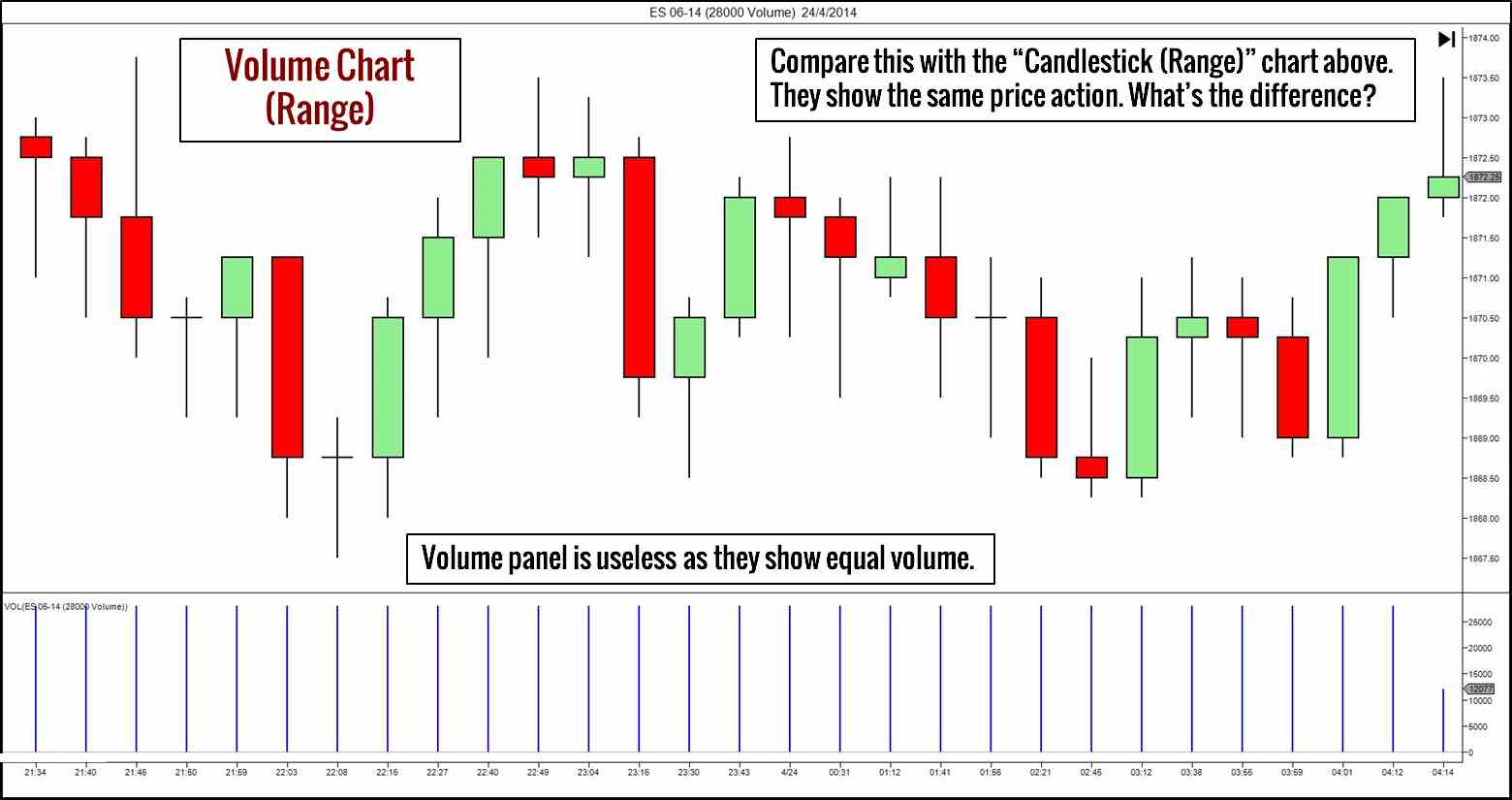

Price Action \u0026 Volume Strategy: The Ultimate Guide for Traders - Siddharth BhanushaliWe study the Bitstamp exchange at the 5-minute frequency to examine the intraday dynamics of Bitcoin returns, volume, volatility and liquidity. The Bitstamp. Volume Weighted Average Cost (VWAP) is a technical study instrument used to measure volume weighted average cost. The VWAP is typically used. Employing GMT-timestamped tick data aggregated to the 5-mintuely frequency, we find that Bitcoin returns have increased over time, while trading volume.